Menu

If you’re a Canadian business owner, there may come a time when you need to move assets into a corporation—whether you’re incorporating your sole proprietorship, setting up a holding company, or reorganizing your existing business for tax or estate planning purposes. The challenge? Such transfers can trigger significant immediate taxes on any gains built up over time.

That’s where Section 85 of the Income Tax Act, commonly known as the Section 85 rollover provision, comes in. This election allows a taxpayer to move eligible assets into a taxable Canadian corporation on a tax-deferred basis, meaning you won’t have to pay tax right away on any built-up gains. Instead, you can push that tax liability into the future, giving you more flexibility and control over your cash flow.

This strategy is especially valuable for sole proprietors who are ready to incorporate and take advantage of benefits like lower small business tax rates and limited liability. It’s also widely used by existing corporations that want to reorganize their assets or transfer property into a holding company as part of a broader tax or estate plan.

In this article, we’ll walk through how the Section 85 rollover works, who qualifies, the rules you need to follow, and some common examples to help you see it in action.

Generally, under subsection 69(1), when a taxpayer disposes of property to a non-arm’s length party, the proceeds of disposition are deemed to equal the fair market value of the property. For example, when you transfer your property as a sole proprietor to a corporation and the property in question has accrued gains, it will be transferred at fair market value, which could create a large tax bill.

A Section 85 rollover is a tax election under the Canadian Income Tax Act that allows a taxpayer (the transferor) to transfer eligible assets to a taxable Canadian corporation (the transferee) in exchange for shares and other non-share consideration. By transferring assets under Section 85, the transferor can avoid triggering immediate capital gains tax at the time of transfer.

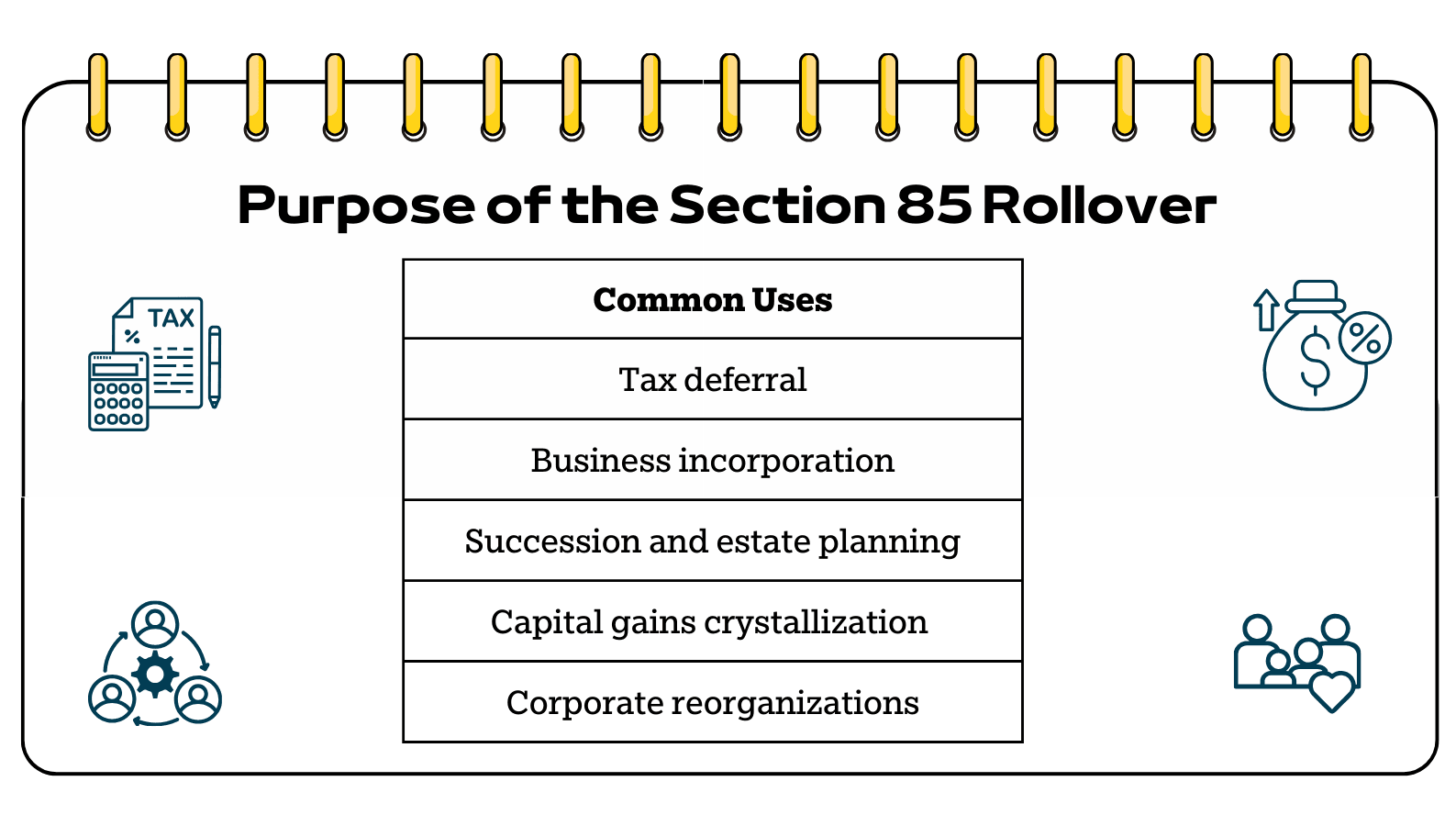

The Section 85 election is a cornerstone of Canadian tax planning and the primary purpose is tax deferral. As such, the rollover exists to provide flexibility and tax efficiency in business structuring. Without it, every time assets are moved into a corporation, owners would face immediate taxes on any appreciation in value—even though nothing was actually sold for cash. Its primary purpose is to enable tax-efficient transfers of property to a corporation. Common uses include:

However, while the Section 85 can result in deferral of tax, the purpose is not to eliminate or reduce the overall tax liability.

To successfully use a Section 85 rollover, there are some key conditions that must be met:

Eligible property includes:

Non-eligible property includes:

Special Limits:

For in-depth technical rules on elected limits, see CRA’s Income Tax Folio S4-F5-C1.

Example 1: Incorporating a Sole Proprietorship and Transfer of Assets

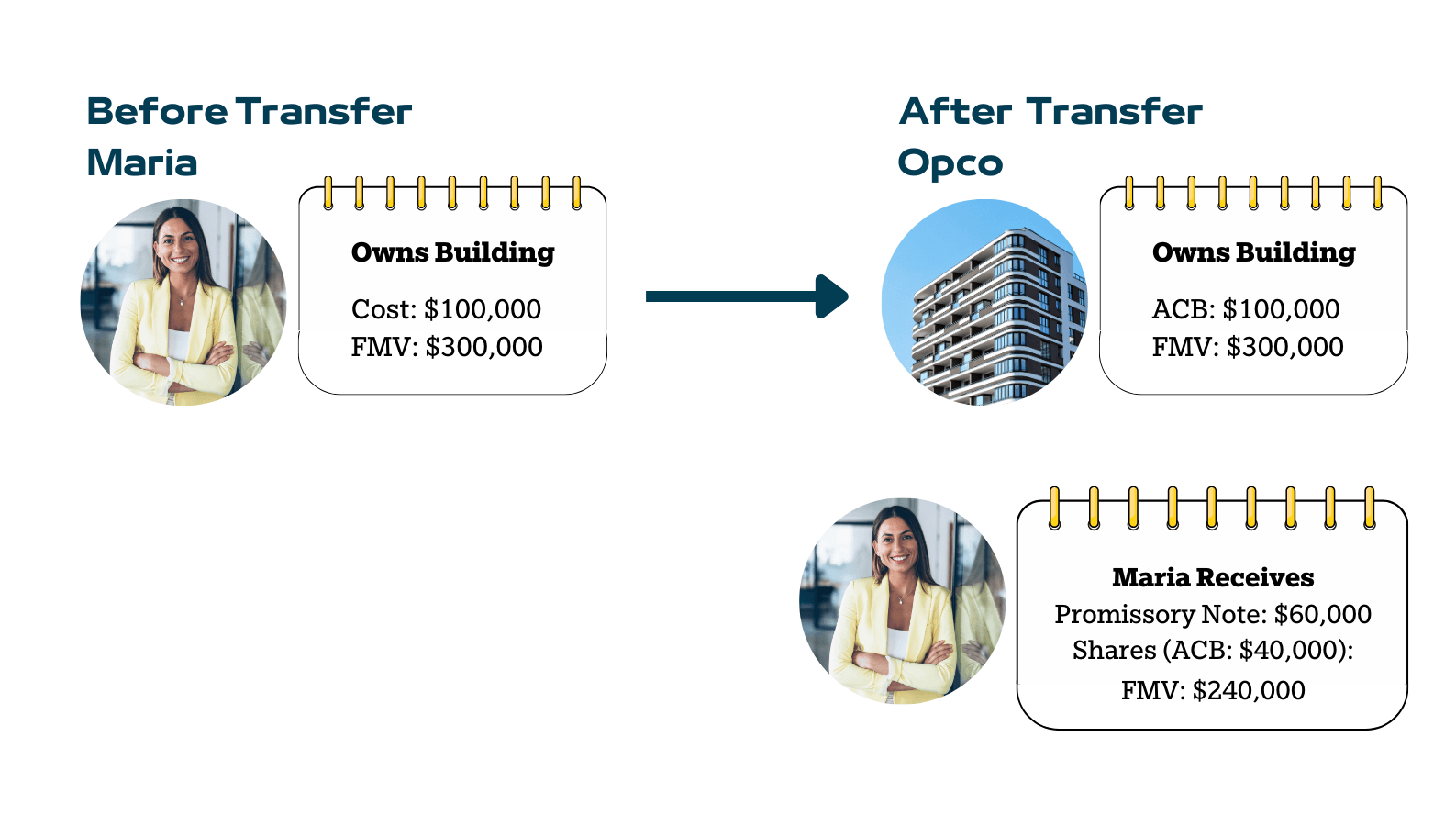

Maria runs business as a sole proprietor and owns building with:

Maria wants to transfer the building into her newly incorporated company (Opco) in exchange for shares and a $60,000 promissory note.

In this way, Maria defers her $200,000 gain until she disposes of her shares in the future.

A summary of the transaction is illustrated below:

To take advantage of the Section 85 rollover, the parties must file Form T2057: Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation and complete the following steps:

The Section 85 rollover is one of the most valuable planning tools available to Canadian business owners. It enables you to incorporate, reorganize, or plan succession while deferring immediate tax liabilities.

That said, the rules can be complex. Proper valuations, transfer agreements, and timely filing of Form T2057 are critical. For this reason, most entrepreneurs rely on professional tax advisors to guide them.

By understanding and applying this powerful rollover strategy, you can grow and restructure your business in a tax-efficient way, deferring taxes until a more strategic time in the future.

Whether you're incorporating, restructuring, or planning for succession, our accountants can guide you through the complexities of the Section 85 rollover. As a full-service accounting firm in Hamilton , our experienced tax accountants are ready to provide the expertise and support you need. Contact us today.

If you want to learn more about other tax and accounting topics, explore the rest of our blog!

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting/tax professionals. NBG Chartered Professional Accountant Professional Corporation will not be held liable for any problems that arise from the usage of the information provided on this page.