Menu

Are tips taxable in Canada? Yes — the Canada Revenue Agency (CRA) considers all tips and gratuities as taxable income. Whether you’re a server, bartender, hairstylist, taxi driver, or work in another service-based role, understanding how tips are taxed is essential for staying compliant and avoiding penalties while increasing your financial benefits, such as higher CPP contributions and more RRSP contribution room.

This article explains the tax treatment of direct, controlled, and declared tips, how to report them, employer and employee responsibilities, and the benefits of declaring all gratuities.

A tip or gratuity is defined as any payment voluntarily given by a customer to a service provider beyond the amount charged for the service itself.

Tips are not legally mandatory in Canada, though they're customary in many service industries. Typically, customers provide gratuities ranging from 15% to 20% of the pre-tax bill amount, depending on the quality of service received. In some establishments, particularly for larger groups, an automatic gratuity of 15-18% might be added to the bill.

It's important to understand that, regardless of how tips are received—whether in cash, added to credit card payments, or through digital transfers—tips are considered taxable income by CRA.

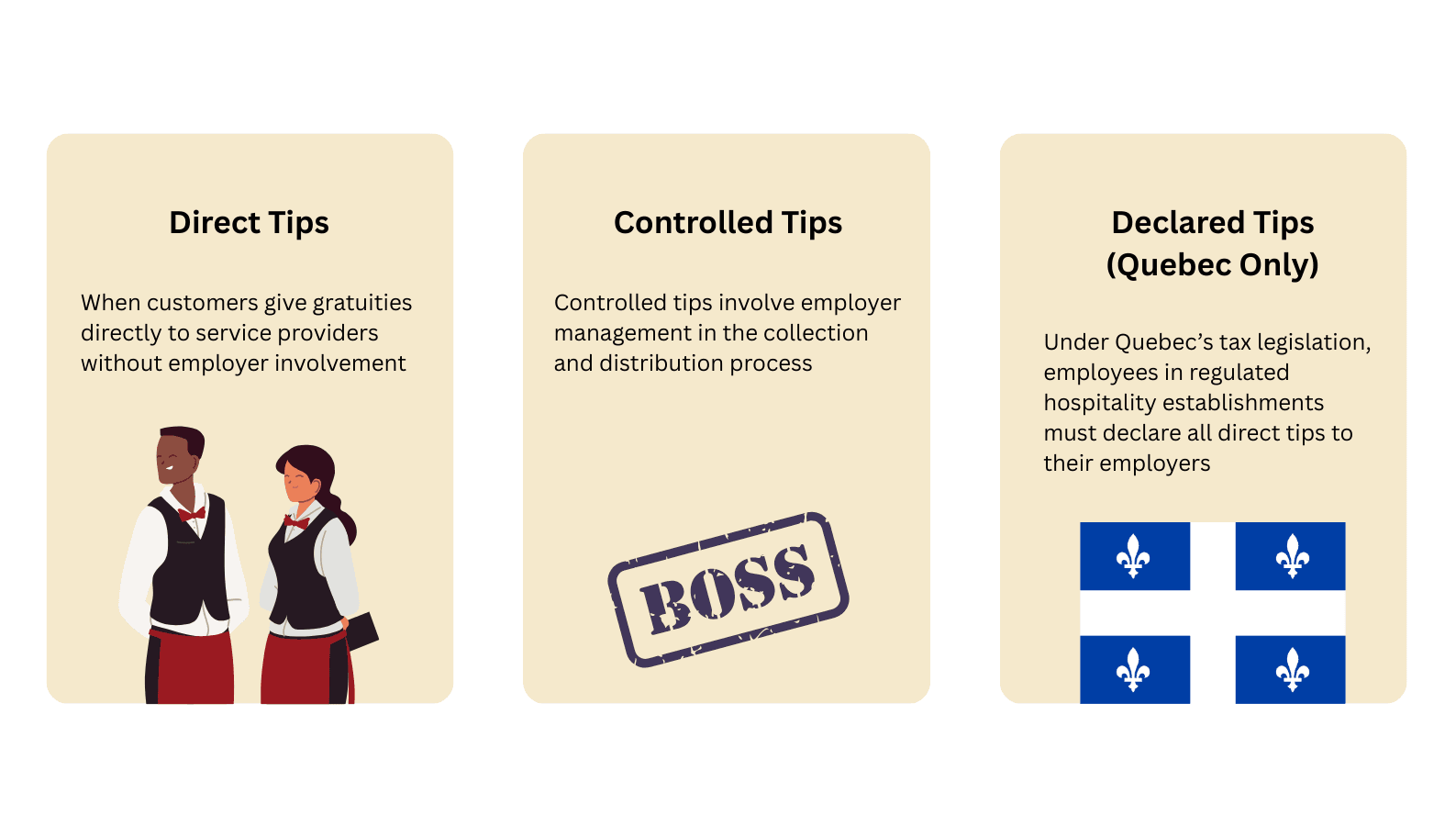

The CRA recognizes different categories of tips, each with specific tax implications. Understanding which type of tips you receive affects how you report them and what deductions might apply.

Direct tips occur when customers give gratuities directly to service providers without employer involvement. These include:

Controlled tips involve employer management in the collection and distribution process. Examples include:

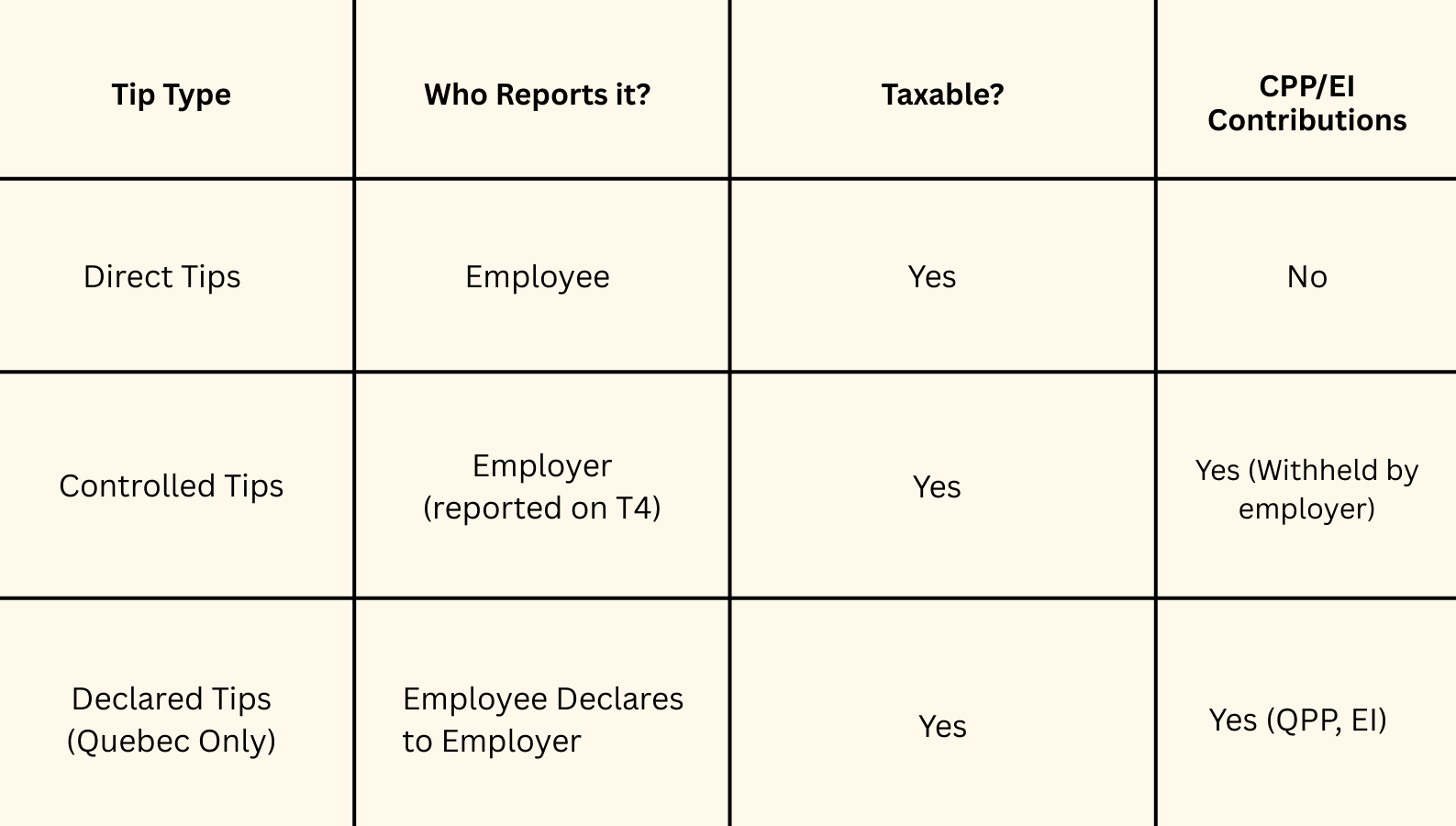

Quebec stands apart from other provinces with its unique system. Under Quebec’s tax legislation, employees in regulated hospitality establishments must declare all direct tips to their employers. Both direct and controlled tip earnings are then combined and included in the employee's insurable wages, thereby making them subject to QPP, EI and income tax accordingly.

Yes, all tips and gratuities are considered taxable income in Canada. The CRA expects service industry workers to report all tips received, regardless of how they were paid.

This includes cash tips, credit card tips, and digital gratuities. Tips are subject to the same tax treatment as regular employment income, meaning they're included in your total employment income. However, depending on whether you earn controlled or direct tips, the tax implications to the employee and employer can differ.

The taxation of tips isn't a suggestion—it's a legal requirement. Failing to report tip income can lead to serious consequences, including penalties, interest charges, and potential audits.

Employers and employees in the service industry have specific obligations regarding the handling and reporting of tips:

With controlled tips, since these are controlled by the employer, the employer is considered to have paid these amounts to the employee. As such, employers must include controlled tips on:

Unlike direct tips, controlled tips are subject to CPP and EI, and hence the employers must withhold both CPP and EI before distribution.

As these are controlled by the employer, the employee has to report the amount included for tips on their T4 on Line 10100, Employment of your tax return.

With direct tips, employers generally have no reporting obligations since these gratuities pass directly from customers to employees without employer involvement. The responsibility for reporting direct tips falls entirely on the employee. Some progressive employers provide systems or tools to help employees track their tips, which can simplify tax reporting while ensuring compliance.

With direct tips, the employees are fully responsible for tracking and reporting direct tips on their tax returns. Generally, the employee reports these amounts on Line 10400, Employment income not reported on a T4 slip of their tax return. Further, though direct tips are considered taxable income to the employee, it is not subject to EI and CPP.

The chart below summarizes the key differences between the various types of tips, and the tax reporting obligation of each.

Although it may seem tempting to underreport tip income to save on taxes, there are significant long-term advantages to declaring all gratuities. Properly reported tips increase your official income, which can improve your ability to qualify for mortgages, car loans, or even rental housing since lenders and landlords rely on documented income to assess applications. Reporting tips also directly affects your Canada Pension Plan (CPP) contributions and your Registered Retirement Savings Plan (RRSP) contribution room. For example, if you earn $500/month in tips, reporting them adds $6,000 to your official income for the year, which increases RRSP room by $1,080 (18%). Over time, this can lead to higher CPP benefits in retirement and more tax-sheltered savings opportunities.

Just as importantly, reporting tips provides peace of mind. Staying compliant with tax laws eliminates the risk of audits, penalties, and interest charges. In the long run, the financial security and opportunities that come with accurate reporting far outweigh the short-term savings of leaving tips unreported.

Failing to report tips in Canada can have serious consequences. The CRA treats gratuities as taxable income, which means leaving them off your tax return could result in back taxes, daily accruing interest, and costly penalties. In cases where the CRA believes the omission was intentional or due to gross negligence, they may impose a Gross Negligence Penalty of up to 50% of the unreported income in addition to the taxes already owed.

Beyond the financial impact, not reporting tips can also increase your chances of being audited. The CRA may compare your reported income to industry averages, review your bank deposits, or even question your lifestyle to uncover discrepancies. What may seem like a small omission today could create major financial and legal stress in the future, making accurate reporting the safest and most beneficial choice.

Understanding how tips are taxed in Canada is essential for service industry workers. All gratuities—whether direct or controlled—constitute taxable income that must be reported to the CRA. While it might seem advantageous to underreport tips in the short term, the potential penalties and missed benefits make compliance the wiser choice.

By keeping accurate records and reporting your tips honestly, you not only stay on the right side of the CRA but also set yourself up for long-term financial security. Whether you’re serving tables, cutting hair, driving passengers, or working in any other service role, treating your tips as legitimate income is the smartest way to protect yourself and build a stronger financial future.

If you work in the service industry and are facing CRA audit regarding your income from tips and gratuities and are looking for an accountant in Hamilton for professional guidance, contact us today. We are a full-service accounting firm in Hamilton , our experienced tax accountants are ready to provide the expertise and support you need.

If you want to learn more about other tax and accounting topics, explore the rest of our blog!

1. Do I have to report cash tips in Canada?

Yes. All cash tips are taxable and must be included on your income tax return.

2. Are tips taxed differently in Quebec?

Yes. Quebec requires employees in certain industries to declare direct tips to their employer, who includes them on the T4 slip.

3. What happens if I don’t report my tips?

The CRA may apply penalties, interest, and even audits if unreported tip income is discovered.

Disclaimer

The information provided on this page is intended to provide general information. The information does not take into account your personal situation and is not intended to be used without consultation from accounting/tax professionals. NBG Chartered Professional Accountant Professional Corporation will not be held liable for any problems that arise from the usage of the information provided on this page.